How to Choose the Best Long-Term Care Insurance (LTCI) for you

Today, Long-Term Care Insurance comes in many forms. The best Long-Term Care Insurance policy for you might be a traditional guaranteed renewable comprehensive policy. It is possible, however, the best long-term care insurance policy might be one that only provides for care in your home. Or the finest Long-Term Care Insurance coverage might be a rider on an insurance policy. In order to find the right long term care insurance policy for your situation, you should first understand six (6) key features.

Your six (6) key features to determine the best long-term care insurance for you

When deciding on the best long-term care insurance policy, there are six (6) key features that affect the price you will pay:

- Benefit Amount

- Home & Community Care

- Benefit Period

- Waiting Period

- Age

- Inflation Fighter

By understanding these key features of a typical long-term care insurance policy, you can design the best plan for your unique financial situation.

Benefit Amount

The benefit amount in most long-term care insurance policies is the maximum amount an insurance company will pay out for covered services. It is often expressed as an amount paid each day, However, sometimes it is based on a weekly amount (seven times the daily benefit) or monthly amount (30 times the daily benefit).

When determining the benefit amount, the emphasis is usually placed on the amount of Facility Care a policy provides. This does not mean the policy will provide only care in a facility. Your policy could be designed to provide you with all levels of care in your home or in your community.

Amount of Coverage varies from state to state, even from place to place with a state.

What Benefit Amount is Right For You?

Home and Community Care

In our opinion, some of the best long-term care insurance policies provide benefits for care in your home or through your community could help keep you out of a nursing home. A variety of Support Services could be provided at or near your home by this type of benefit.

Typical policies calculate the home and community care benefit as a multiple of the Daily Benefit amount.

- A one hundred percent (100%) benefit. This provides you an equal amount of the facility benefit for home or community-based care.

- A fifty percent (50%) benefit. This provides you half the amount of the facility benefit home or community-based care.

- A zero percent (0%) benefit. This provides no care for services provided in a home or through the community. Therefore, this benefit is for a person only seeking long-term care insurance coverage for care in a nursing home or similar facility.

Cost of care varies depending on the level of care. Therefore, if you receive Skilled Care, it will generally cost more than Unskilled Care.

Policies typically provide benefits on a Stand-By and/or Hands-On Basis. The ideal policy includes both definitions of assistance.

If you were to receive care in your home, how much of the Daily Benefit would you want to receive for Home & Community Care?

Benefit Period

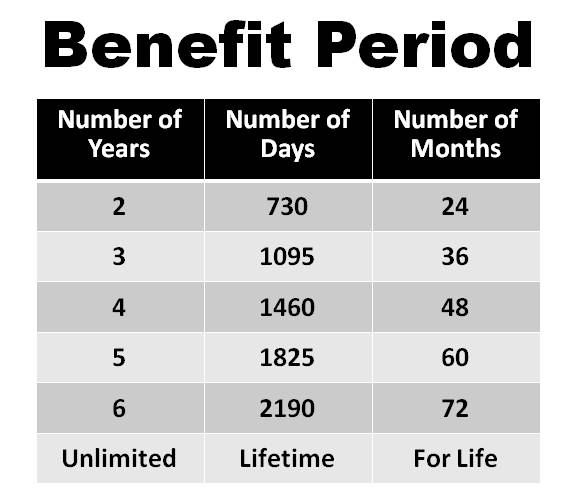

The Benefit Period is the length of time you are eligible to receive benefits. Some policies pay time-based benefits for a certain predetermined number of days, month or years.

Sometimes instead of a set number of days, months or years, you will receive benefits, the Benefit Period is expressed as a pool of money, or maximum dollar amount available for care. An insurance company might express the duration by years, days or months. Common benefit periods are:

Nobody knows exactly how long they may need care. As a result, there are reports and studies which can give you an insight to national averages, you much choose how long you might want your benefits to last.

How many years would you like to receive benefits for your care?

Waiting Period

The Waiting Period or Elimination Period is the number of days that you must receive long term care services prior to your policy paying a benefit towards your care. Some policies may offer a “zero-day wait” or “no elimination period” where benefits could be paid immediately. Besides zero (0) days, other common waiting periods are 30 days, 60 days, 90 days, 180 days and 365 days.

Sometimes the Waiting Period is considered a “deductible”. In an auto insurance policy, the higher the deductible, the lower the premium. As a result, in a long term care insurance policy, the longer you can wait to receive benefits from the policy, the lower the premium, but the potential out of pocket expenses go up.

For example, a zero (0) day Waiting Period costs more than a 90 day Waiting Period. But if you go on claim, the zero-day plan could begin paying expenses from the first day. With a 90 day Waiting Period, assuming Medicare does not pay, you could end up paying the costs for care during the first 90 days. If you chose a $100 per day Benefit Amount, that could be a $9,000 deductible (90 days times $100 per day).

Waiting periods might be once in a lifetime or per occurrence. If you can be comfortable with possibly paying the “deductible”, you might want to have one in your policy. however, if you are uncomfortable paying any expenses out of pocket, then a zero (0) day Waiting Period may be in order.

What Waiting Period is right for you?

Age

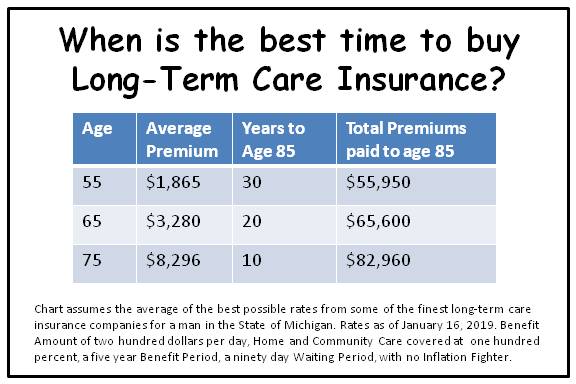

Your age determines the price you will pay for coverage. Essentially, the younger you are when you purchase a long term care insurance policy, the lower the premium will be. also, by purchasing your policy now you will pay less over your lifetime than if you wait until you are older to buy your policy. Consider these typical average premiums for a comprehensive policy of an individual buying a $200 per day ($6,000 per month) Benefit Amount, 100% Home and Community Care, a five (5) year Benefit Period, a ninety (90) day Waiting Period, with no Inflation Fighter:

What is your current age?

Inflation Fighter

Inflation Fighter is designed to help your policy keep pace with inflation. Essentially, this feature increases your Daily Benefit amount and maximum Lifetime benefit. There is usually an additional premium charged for inflation protection. Increases generally take effect on the policy anniversary date, the month and day your policy became effective. Referred to as the cost of living increases or annual benefit increases, these optional riders are:

- Compound Cost of Living – On your policy anniversary date (once a year), the Benefit Amount is increased by a percentage. As a result, there is an increase in Benefit Amount, but not an increase in premium. This feature could continue indefinitely.

- Simple Cost of Living – On your policy anniversary date (once a year), the Benefit Amount is increased by a percentage. As a result, there is an increase in Benefit Amount, but not an increase in premium. This feature could continue indefinitely.

- Options to Purchase (also known as Future Purchase Options) – At each option date, you have the right to increase your Benefit Amount based on the Consumer Price Index (or another formula). Consequently, unlike Simple or Compound Cost of Living, your premium will increase using rates for your current age, not your age when the policy was issued. You have the right to decline the increase, but usually multiple declinations voids this feature. Furthermore, this feature usually has an expiration date, such as, by age 78.

Here is an example of the effect of Simple and Compound adjustments on a $200 Daily Benefit:

The cost of long-term care has increased in the past and is expected to continue. Inflation protection can increase your benefits to help you pay for these rising long-term care costs.

If you want Inflation Protection, which feature is right for you?

Six (6) Feature Summary

If you can answer these six key questions, you can begin designing the best long-term care insurance plan to meet your needs.

What Daily Benefit Amount is right for you?

What Daily Benefit Amount is right for you?- If you were to receive care in your home, how much of the Daily Benefit would you want to receive for Home & Community based care?

- How many years would you like to receive benefits for your care?

- What Waiting Period is right for you

- What is your current age?

- If you want Inflation Protection, which feature is right for you?

Additional Considerations

How Much Does Long Term Care Insurance Cost?

The cost of long term care varies depending on what you select for benefits. It also depends on your health history at the time you buy the insurance. Generally speaking, the younger and healthier you are the lower the cost.

How do you want to pay for it?

Do you want to pay:

- a single payment into an insurance product with a long-term care insurance rider?

- or a regular recurring premium into an insurance product with a long-term care insurance rider?

- or a regular recurring premium into a traditional long term care insurance policy?

Eight (8) Policy Details You May Want To Know

Here are eight (8) other policy details that you might want to review as you select the best Long-Term Care Insurance policy for you.

#1 Bed Reservation

Many policies will pay for your bed at a facility to be available for you to return to if you are temporarily absent during the course of stay. This could be important if you are gone for a weekend visit or if a medical condition sends you to a hospital and you are staying in a facility that is filled to capacity. This feature commonly covers 15, 21 or 30 days, but could cover any period of time.

#2 Respite Care

Your informal caregiver, the person who has the primary responsibility of caring for you in your home, might need some short term relief from the day to day responsibilities. Respite care is the temporary relief of the caregiver for a limited period of days such as 15, 21 or 30 days, but could cover any period of time.

#3 Restoration of Benefits

With this feature, typically after you are no longer on a claim for some period of time (usually for 180 consecutive days), not receiving any treatment and are unimpaired, and if you did not exhaust the policy benefits, the policy would be restored to the original lifetime benefit. For example, you buy a four-year benefit, enter a nursing home for three years, are released fully recovered, with no further treatment and unimpaired for at least 180 days, next time you need care, you will have another four years of benefits, not just one. This is usually sold as a rider at an additional cost. Policies do vary on benefits and terms. Restoration only applies if you have any benefit period other than a lifetime.

#4 World Wide Coverage

Few policies will pay benefits for care received anywhere in the world. Most are restricted to care in or around the United States, or with limited duration of care abroad.

#5 Waiver of Premium

Most long term care insurance policies allow you to cease payment of premiums after receiving benefits for a certain number of days. The insurance company considers this a waiver of your premium while you are on claim. Once you recover and are no longer receiving care, the payment of premium usually resumes. You do not have to pay anything back, and nothing is deducted from your benefits. Some policies waive the premium for any type of care, some limit the waiver of premium to certain types of care.

#6 Indemnity versus Reimbursement

Most Long-Term Care Insurance reimburses your long term care qualifying expenses incurred for your care while on claim. A reimbursement policy will typically pay the lesser of the actual expense incurred or the maximum daily, weekly or monthly benefit. You do not receive the money, the insurance company pays your care provider directly. Some policies have a feature to pay you in cash (indemnity). With an indemnity payment, you can spend on your care or other expenses, however you see fit.

#7 Non-Forfeiture

Non-Forfeiture is provided as a rider at an additional cost and makes available continued coverage over your lifetime if you stop paying premiums. Typically the policy must be in force for three years or more for this benefit to take effect. When you cease payment of premiums after three years, the amount of money you have paid into your policy becomes the maximum policy account. If you were to go on a claim using a Non-Forfeiture feature, your policy would pay benefits per the policy schedule until the money in your policy account (all the premiums you paid into your policy) is exhausted.

#8 Care Coordination

Finding someone to provide care in your home might seem a difficult task. Who do you call? You could call local home health care agencies and the local Agency on Aging. But what other services are available? What services have you overlooked? Care Coordination, also known as case management or care management, is a process of assessing needs, planning, coordinating, implementing and monitoring a plan of care to a person in need of long term care services. The care coordinator acts as your advocate for selecting the best options, providers, and facilities for your care. Most insurance companies offer this service as a routine part of their coverage to assist in finding the best available care. Generally, this service is provided to improve the quality of care you receive in your home or through your community.

You might want to compare companies

There are a few rating services that analyze the financial strength of insurance companies. The financial strength of an insurance company is a very important factor to consider when purchasing long term care insurance. Claim payments are backed by the financial strength and claims-paying ability of the insurance company or companies you chose. Hence, it may be in your best interest to choose a highly rated insurance company, or better yet, more than one company. You can check ratings from sources like AM Best, Fitch, Moody’s and Standard and Poor’s.

In Conclusion:

We have been helping people like you find the best long-term care insurance since we started in 1998. Once you determine six key features like benefit amount, home and community care, benefit period, waiting period, age and inflation fighter, you are in a good position to find the best long term care insurance coverage for you. in the event you need care due to a chronic illness or injury.

Finally

If you have any questions about the Long-Term Care insurance (LTCI) or LTCI insurance riders or just need a little guidance, feel free to contact us. We know long-term care planning can be confusing, so it is important to get the facts before you make any long-term decision.